Liquidators' roles and responsibilities

ABLV liquidators' roles and responsibilities are stipulated by the Credit Institution Law

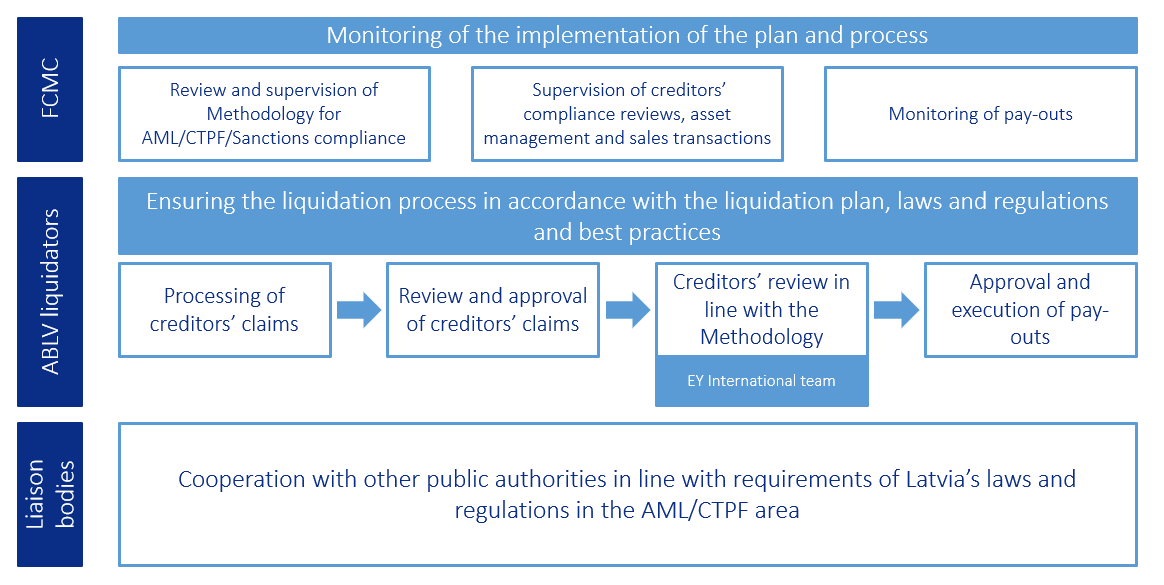

ABLV liquidators have entered into an agreement with an international sworn auditors' team from the firm Ernst&Young (EY), the main tasks of which are:

- To draw up Methodology for monitoring AML/CTF/Sanctions compliance to prevent possible money laundering, infringement/circumvention of sanctions requirements in the pay-out and asset sales processes;

- To carry out screening of creditors/potential purchasers of bank assets in line with the Methodology drawn up by EY and approved by the ABLV liquidators.

ABLV creditors' reviews

Latvijas Latvijas Banka's oversight:

- ABLV asset management and compliance of voluntary liquidation process with laws and regulations

- liquidators' operations and their compliance with laws and regulations

- compliance of voluntary liquidation process with AML/CTF/Sanctions requirements, including in the course of drawing up the Methodology and creditors' review

- whether the interests of creditors are protected within the voluntary liquidation process

- compliance of the process with the ABLV Liquidation Plan, which formed the basis of the Financial and Capital Market Commission's decision (of 12.06.2018) to authorise the opening of ABLV voluntary liquidation.

Customer and creditor service and contact details

Information on the voluntary liquidation process and key issues is available on the ABLV website. In case any questions arise, we invite at all times to reach ABLV first to obtain an answer. Contact details for ABLV available on the ABLV website. For communication with ABLV, it is also proposed to use internet banking for receiving up-to-date information, sending applications and receiving statements. Information is available on the ABLV website.

Information to depositors

Pursuant to Section 3, Paragraph four of the Deposit Guarantee Law, the depositors of ABLV Bank, in liquidation, who are eligible for the guaranteed compensation but who will not apply for it by 23 February 2023 will lose their right of claim against the Deposit Guarantee Fund of Latvia concerning the disbursement of the guaranteed compensation on 24 February 2023.

Please note that AS Citadele banka ensures disbursement of the guaranteed compensation to depositors of ABLV Bank AS in liquidation. More information on the application procedure is available on the Citadele banka website.

Contact details for ABLV Bank clients regarding guaranteed compensation:

- ABLV Bank client lines: +371 67775555, +371 67775222

- ABLV Bank e-mail:

This email address is being protected from spambots. You need JavaScript enabled to view it. - Latvijas Banka client lines: +371 67022883, +371 67022882

- Latvijas Banka e-mail:

This email address is being protected from spambots. You need JavaScript enabled to view it.

All customers and creditors may submit to Latvijas Banka their applications and claims on ABLV. This information will be processed by Latvijas Banka in accordance with the procedures and timeframe specified in laws.