I. Purpose

1. The purpose of the advisory guidelines for the application of the minimum reserves (hereinafter, the Guidelines) is to inform the MFIs subject to the reserve requirements on the application and calculation of the minimum reserves and compliance with the reserve requirements.

II. Application of the minimum reserves

2. Minimum reserves apply to credit institutions registered in the Republic of Latvia, branches, registered in Latvia, of credit institutions registered in other countries, and credit unions registered in the Republic of Latvia (hereinafter, the respondents). Minimum reserves do not apply either to branches of credit institutions, registered in the Republic of Latvia, in other countries or the respondents who have been exempted by the European Central Bank (hereinafter, the ECB) from the compliance with the reserve requirements.

3. The ECB publishes a list of the MFIs subject to the reserve requirements (see section The population of MFIs subject to the Eurosystem's minimum reserve requirements and not exempt) at https://www.ecb.europa.eu/stats/money/mfi/general/html/monthly_list.en.html.

II. Calculation of the minimum reserves

4. The reserve requirement calculation, reserve ratios and their application to the calculation of the reserve requirements have been stipulated in ECB Regulation No. 1745/2003 of 12 September 2003 on the application of minimum reserves and any amendments thereto (hereinafter, Regulation No. 1745/2003; see the consolidated Regulation No. 1745/2003 at http://www.ecb.int/ecb/legal/pdf/02003r1745-20120118-en.pdf and http://www.ecb.int/ecb/legal/pdf/02003r1745-20120118-lv.pdf).

5. According to Regulation No. 1745/2003, the deposits received and debt securities issued by the respondent are included in the reserve base. The liabilities included in the reserve base should be interpreted, taking into account ECB Regulation No. 25/2009 of 19 December 2008 concerning the balance sheet of the monetary financial institutions sector (see the ECB website at: http://www.ecb.int/ecb/legal/pdf/l_01520090120en00140062.pdf and http://www.ecb.int/ecb/legal/pdf/l_01520090120lv00140062.pdf).

6. In order to comply with the requirements of Regulation No. 1745/2003, the form "Calculation of the Reserve Base and Requirement" is incorporated in the Bank of Latvia Regulation No. 109 "Regulation for Compiling the "Calculation of the Reserve Base and Requirement". The respondents have to fill in the form "Calculation of the Reserve Base and Requirement" and submit it to the Bank of Latvia no later than within seven business days after the end of the reporting period. The respondent submits the filled-in form "Calculation of the Reserve Base and Requirement" to the Bank of Latvia electronically in accordance with the Bank of Latvia's regulation stipulating the procedure for electronic exchange of information with the Bank of Latvia.

7. In the form "Calculation of the Reserve Base and Requirement", amounts are reported in whole euro.

8. Where item "Reserve requirement" of the filled-in form "Calculation of the Reserve Base and Requirement" results in a negative value, the reserve requirement for the respondent for the respective maintenance period is 0 euro.

9. The respondent submits the form "Calculation of the Reserve Base and Requirement" to the Bank of Latvia also in cases where the values of all items of the form are 0.

10. Pursuant to Regulation No. 1745/2003, the respondent's liabilities to MFIs included on the list of MFIs subject to reserve requirements, published by the ECB, as well as liabilities to the ECB and central banks of the euro area countries are excluded from the reserve base (see the list of the MFIs in section The population of MFIs subject to the Eurosystem's minimum reserve requirements and not exempt at https://www.ecb.europa.eu/stats/money/mfi/general/html/monthly_list.en.html.

11. In applying the provisions of Paragraph 10 herein with respect to the debt securities issued by respondents, a respondent must provide evidence to the Bank of Latvia of the actual amount the reserve base has been reduced by. Where the respondent cannot present such evidence on the debt securities issued, it may use a standardised deduction of 15% from the amount of the issued debt securities (with original maturity of up to 2 years) included in the reserve base. Information on the standardised deduction and the current percentage to be deducted is published in section Standardised deductions on the ECB website at http://www.ecb.int/mopo/implement/mr/html/calc.en.html.

12. The amount of minimum reserves to be held by the respondent over the particular maintenance period is calculated by applying the reserve ratios, established by Regulation No. 1745/2003, to the reserve basis. The ECB also publishes the reserve ratios in Section Reserve coefficients on its website at https://www.ecb.europa.eu/mopo/implement/mr/html/calc.en.html. Pursuant to Regulation No. 1745/2003, a reserve ratio of 1% is applied to deposits with agreed maturity of up to 2 years, deposits with the period of notice of up to 2 years, and debt securities issued with original maturity of up to 2 years. A reserve ratio of 0% is applied to all other liabilities included in the reserve base.

13. The minimum reserves are calculated by applying the lump-sum allowance of 100 000 euro, stipulated by Regulation No. 1745/2003, to the amount of minimum reserves referred to in Paragraph 12 herein. Information on the lump-sum allowance is published in section Lump-sum allowance on the ECB website at http://www.ecb.int/mopo/implement/mr/html/calc.en.html.

IV.Compliance with the reserve requirements

14. Pursuant to Regulation No. 1745/2003, the ECB publishes a calendar of the maintenance periods at least three months before the start of the current calendar year (see the ECB website at http://www.ecb.int/events/calendar/reserve/html/index.en.html).

15. Credit institutions registered in the Republic of Latvia and branches, registered in Latvia, of credit institutions registered in other countries (hereinafter, a credit institution) calculate the reserve base in respect of a particular maintenance period on the basis of the data relating to the month two months prior to the month within which the maintenance period starts. For example, the reserve requirements for the maintenance period beginning in the middle of January are calculated on the basis of the respondent's monthly financial position data for November.

16. A credit union registered in the Republic of Latvia (hereinafter, the credit union), submitting its "Monthly Financial Position Report" to the Bank of Latvia only about the positions as at 31 March, 30 June, 30 September and 31 December, calculates reserve requirements for three maintenance periods, beginning with the one starting within the third month after the end of the quarter, on the basis of the end-of-quarter data.

17. The respondent's end-of-day balance on the reserve account with the Bank of Latvia is taken into account when defining compliance with the reserve requirements, remuneration for compliance with the reserve requirements and penalty in the event of non-compliance with the reserve requirements. For defining compliance with the reserve requirements, the average end-of-day balance on the reserve account with the Bank of Latvia is calculated for the whole maintenance period. Pursuant to the procedure stipulated by Regulation No. 1745/2003, a respondent may use an opportunity to hold the minimum reserves indirectly through an intermediary.

V. Imposition of sanctions

18. The Bank of Latvia compares the average end-of-day balance on the respondent's reserve account with the Bank of Latvia and the calculated reserve requirements submitted by the respondent. The Bank of Latvia notifies the respondent of the breach of the obligation to hold minimum reserves and the corresponding sanctions, imposed by the ECB, by sending the respondent a letter.

19. The powers of the ECB to impose sanctions upon discovery of the breach of the obligation to hold minimum reserves is stipulated by ECB Regulation No. 2157/1999 of 23 September 1999 on the powers of the European Central Bank to impose sanctions (see the ECB website at: http://www.ecb.int/ecb/legal/pdf/en_ecb_1999_4.pdf and http://www.ecb.int/ecb/legal/pdf/lv_ecb_1999_4.pdf).

20. The application and calculation of the charge for the breach of the obligation to hold minimum reserves is stipulated by the ECB document Notice of the European Central Bank on the imposition of sanctions for breaches of the obligation to hold minimum reserves (2000/C 39/04; see the ECB website at: http://www.ecb.int/ecb/legal/pdf/en_notice_2.2.6.pdf).

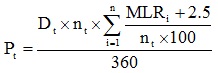

20.1 Pursuant to the ECB document on the non-compliance with the reserve requirements, referred to in this paragraph, the ECB applies penalty sanctions to be calculated using the following formula:

where:

Pt – penalty to be paid owing to the lack of the required reserves for the maintenance period t;

Dt – the amount of required reserves lacking for the maintenance period t (as a daily average);

nt – number of calendar days in the maintenance period t;

i – the calendar day of the maintenance period t;

MLRi – marginal lending facility rate on day i.

20.2 Where the respondent's breach of the obligation to hold minimum reserves occurs more than twice in a period of 12 months, it is deemed a repetitive breach. For each repetitive breach, a penalty sanction is imposed, calculated using the formula laid down in Paragraph 20.1 herein, replacing the numeral 2.5 with 5.0 in it.