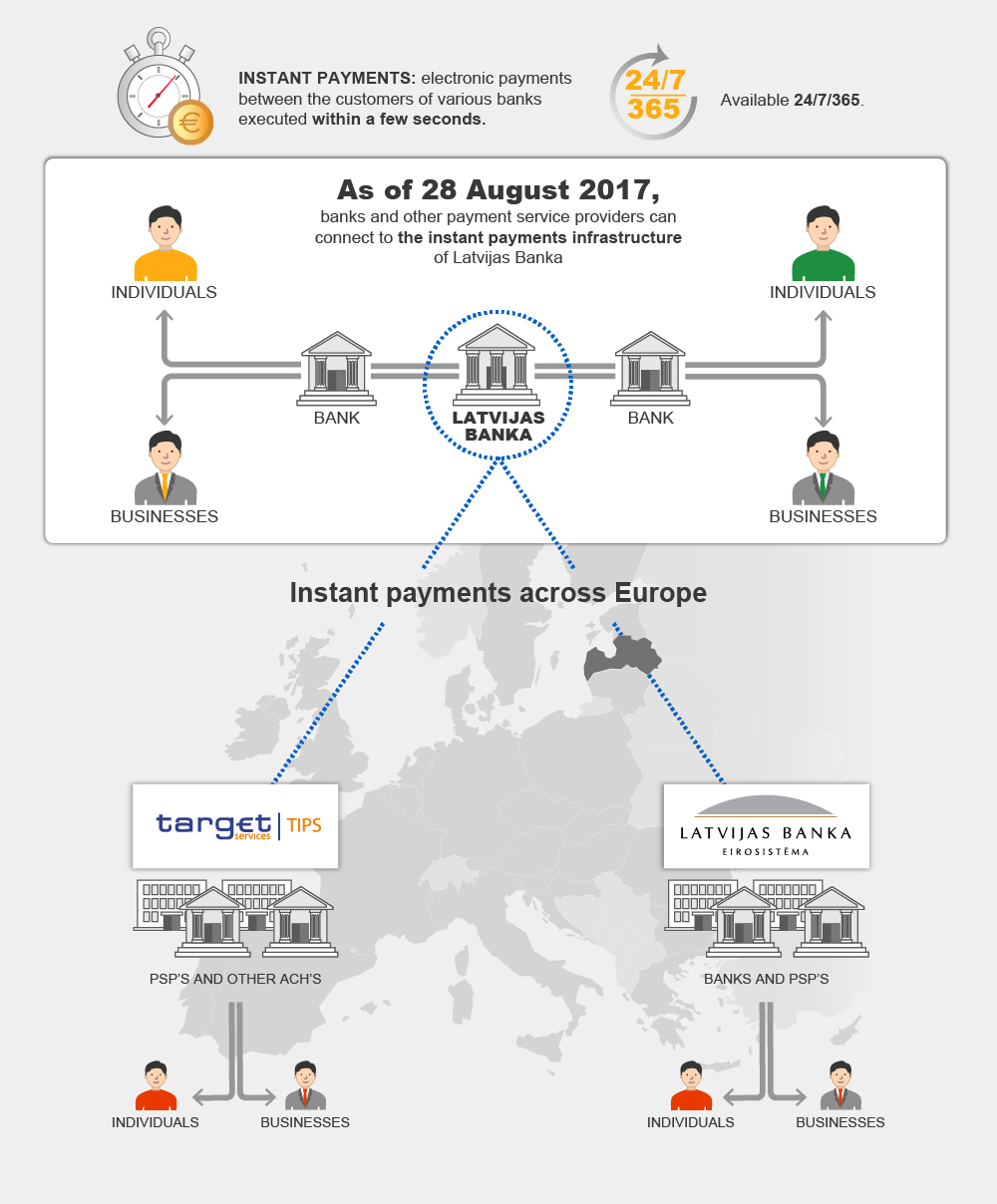

Latvijas Banka has developed a system enabling payment service providers to provide instant payment services to their customers: an opportunity to transfer money from an account in one payment service provider to an account in another payment service provider within a matter of seconds on any day and at any time of the day.

FAQs on instant payments