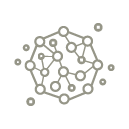

FINTECH glossary

An online service through which the service user can see account balance information of accounts from various credit institutions in a single application.

An online service through which the service user can see account balance information of accounts from various credit institutions in a single application.

Using API technology and user's granted access rights, consolidated information regarding one or more payment accounts held by the payment service user with either another payment service provider or with more than one payment service provider is provided to the payment service user.

Anti-money laundering and combating the financing of terrorism and proliferation.

Anti-money laundering and combating the financing of terrorism and proliferation.

Requirements aimed at preventing money laundering and countering the financing of terrorism.

Software enabling immediate interaction between two systems. Systems use API to transfer information and execute operations on behalf of their users.

Software enabling immediate interaction between two systems. Systems use API to transfer information and execute operations on behalf of their users.

API is a set of predefined procedures, functions and structures. It is implemented as an add-on (service) which can be used with external software products. API is used by software developers to create various software add-ons and interconnect systems.

An area of computer science that emphasises the creation of intelligent machines which use data analysis and algorithms to make independent judgements, take rational decisions and recognise text, speech, sounds, images, faces, scents, emotions and other features of objects and subjects.

An area of computer science that emphasises the creation of intelligent machines which use data analysis and algorithms to make independent judgements, take rational decisions and recognise text, speech, sounds, images, faces, scents, emotions and other features of objects and subjects.

With artificial intelligence, natural abilities are transferred to machine environment. This leads to the automation and robotization of processes and operations. The development of this technology enables us to use machines in our every-day processes, thus making our lives easier. With artificial intelligence becoming increasingly more advanced, some emerging devices use their computing capacity to adopt new ways of learning by taking atypical decisions and assigning new characteristics to existing things.

Generally used to refer to large volumes of different types of data, processed with high velocity from many and varied sources.

Generally used to refer to large volumes of different types of data, processed with high velocity from many and varied sources.

Big data approach is used by, e.g., the internet of things, sensors, social media, financial markets data, etc., which are processing the data, often in real time, by IT tools (powerful processors, software and algorithms).

Refers to large, globally active technology firms with a relative advantage in digital technology, mostly on account of their market position and a very wide range of users.

Refers to large, globally active technology firms with a relative advantage in digital technology, mostly on account of their market position and a very wide range of users.

The term Big Tech is most commonly used to refer to GAFAM (U.S.) – Google, Amazon, Facebook, Apple and Microsoft – and BAT (China) – Baidu, Alibaba, Tencent – as well as other global tech giants.

A decentralised database; a continuously growing list of blocks (records). Each block contains a time stamp and a cryptographic reference to the previous block. To alter a previously created block, all subsequent blocks would also have to be altered. Therefore, the blockchain technology is secure.

A decentralised database; a continuously growing list of blocks (records). Each block contains a time stamp and a cryptographic reference to the previous block. To alter a previously created block, all subsequent blocks would also have to be altered. Therefore, the blockchain technology is secure.

The blockchain technology was developed in 2008 by a hacker or group of hackers under the pseudonym Satoshi Nakamoto for the purpose of creating and maintaining the bitcoin crypto asset. After witnessing the success of bitcoin, other developers also used the blockchain technology to create new crypto assets. More than 10 years after the creation of bitcoin, the two elements – crypto assets which are based on the blockchain technology and blockchain itself which can also be used for other purposes – exist independently.

Customer due diligence.

Customer due diligence.

Credit institutions are obliged to perform such checks regularly, in order to assess the customer and obtain objective information, whether it is acceptable to initiate or continue partnership.

A type of project funding where money is raised on an online platform from a large number of supporters rather than a single investor. For their investment, participants receive e.g. interest payments.

A type of project funding where money is raised on an online platform from a large number of supporters rather than a single investor. For their investment, participants receive e.g. interest payments.

Crowdfunding is used to finance various projects such as start-ups at their development stage, real estate construction, etc.

Electronic means of exchange, maintained on a decentralised basis. The permanence of executed transactions is ensured and the emission of new units is controlled by means of cryptography.

Electronic means of exchange, maintained on a decentralised basis. The permanence of executed transactions is ensured and the emission of new units is controlled by means of cryptography.

The first crypto-asset, bitcoin, was introduced in 2009. It was followed by many other blockchain-based crypto-assets. The exchange of crypto-assets takes place on unregulated crypto-asset exchange platforms where participants set the market price based on demand and supply. Users should be aware that crypto-assets are only stored in an electronic environment and they often have no collateral, e.g. in the form of gold or real estate.

Protection of information systems against the theft of or damage to the hardware, software and data, and protection against the disruptions or changes to the provided services.

Protection of information systems against the theft of or damage to the hardware, software and data, and protection against the disruptions or changes to the provided services.

With the development of technologies and their role in providing everyday services, the digital vulnerability is growing; therefore, cybersecurity and the protection of data in particular should be given increasing attention.

A character or sequence of characters stored in physical or electronical form. When combined with knowledge, they become information describing the status of a real object.

A character or sequence of characters stored in physical or electronical form. When combined with knowledge, they become information describing the status of a real object.

Each data unit represents a particular event, object or process. Data can be classified into financial, statistical, geographic, meteorological, nature-related, transport-related, cultural and scientific data.

Data are collected, stored, measured and analysed. Data are supplemented with metadata (data about data) containing information on the time, place, temperature and/or other data collection conditions.

A virtual data storage infrastructure. With the permission of the user, the data are accessible from physical devices such as PCs, tablets and smartphones that have a connection to the internet.

A virtual data storage infrastructure. With the permission of the user, the data are accessible from physical devices such as PCs, tablets and smartphones that have a connection to the internet.

The data are stored in logical sets of data on one server or several network servers which can be located on different sites. These servers are managed by data service providers responsible for data security, continuous operation of servers and access to data. Users buy or rent from these service providers a certain amount of server space for the storage of their data.

Electronic data that are organised in a pre-defined structure and can be accessed via a database management system.

Electronic data that are organised in a pre-defined structure and can be accessed via a database management system.

The type of data to be stored on a database is defined upon its creation. Data are organised in rows and columns, with an index or designation assigned to each of them. This enables users to identify and search the data organised in the database. A database can be updated by entering, modifying or deleting data. Data can be retrieved from a database by using an adequate management system. This way, the data remain unchanged. A database is managed by an administrator who assigns access rights, registers users and is responsible for data integrity, security and the database performance.

Distributed ledgers use independent computers, referred to as nodes, to record, share and synchronize transactions in their respective electronic ledgers.

Distributed ledgers use independent computers, referred to as nodes, to record, share and synchronize transactions in their respective electronic ledgers.

The main difference from a traditional ledger is that, instead of keeping data centralised, the data is stored in a decentralised manner and is linked together with cryptographic elements. Blockchain is one type of a distributed ledger which organises data into blocks, which are chained together in an append only mode.

Regulation on electronic identification and trust services for electronic transactions in the internal market (Regulation (EU) No 910/2014).

Regulation on electronic identification and trust services for electronic transactions in the internal market (Regulation (EU) No 910/2014).

eIDAS Regulation defines the criteria which must be met in order to provide electronic identification services in European Union.

A company which develops and uses new and innovative technologies in the area of financial services. This leads to the development of new financial products and services or a significant improvement of the existing ones.

A company which develops and uses new and innovative technologies in the area of financial services. This leads to the development of new financial products and services or a significant improvement of the existing ones.

A FinTech company can be a start-up developing innovations in a specific field or area. The term can also be applied to technology companies, e.g. companies offering their customers innovative financial management tools via their platforms. By offering a faster, more convenient and cheaper service which attracts a significant number of customers and, thus, also motivates the traditional banks to change, FinTech companies have transformed the financial services sector in a relatively short time.

Digital assets with the features of stablecoins, which are created by BigTech companies with great client base. Introduction of such digital assets would, probably, change the existing financial system.

Digital assets with the features of stablecoins, which are created by BigTech companies with great client base. Introduction of such digital assets would, probably, change the existing financial system.

Global stablecoins are currently only theoretical, as several BigTech companies have defined their interest in creating such assets. The main potential risks associated with the introduction of such digital assets, are related to lack of regulation and global oversight mechanism, that could control the activities performed by these companies, whose client base exceeds many hundreds of millions and even several billions.

Public fund-raising campaign which uses crypto assets and involves an issue of new crypto coins or tokens. Crypto coins or tokens are developed and distributed based on the dispersed accounting technology or the blockchain technology.

Public fund-raising campaign which uses crypto assets and involves an issue of new crypto coins or tokens. Crypto coins or tokens are developed and distributed based on the dispersed accounting technology or the blockchain technology.

Contrary to the traditonal initial public offering (IPO) where shares are sold on the stock market, the initial coin offering does not offer the sale of a company's shares. The transaction involves only crypto assets.

Information and communication technology used for apps and other IT solutions.

Information and communication technology used for apps and other IT solutions.

The development of ICT sector has promoted rapid digital transformation, which is increasingly changing the financial sector as well.

A process whereby new scientific, technological, social, cultural or other ideas, designs and technologies are implemented to create a highly demanded and competitive product or service.

A process whereby new scientific, technological, social, cultural or other ideas, designs and technologies are implemented to create a highly demanded and competitive product or service.

Innovations are classified into product, process, marketing and organisational innovations. Each of these types of innovations represents new solutions, methods and strategies that significantly change and improve the existing work process. Innovation is considered both the creation of an entirely new product, process or method and the change of an existing product, process or method by significantly improving all or one of their aspects.

Ensures cooperation with the competent authority in order to discuss FinTech-related issues (share information and views, etc.) and seek clarification on the conformity of business models with the regulatory framework or on regulatory or licensing requirements (i.e. individual guidance on the interpretation of applicable rules).

Ensures cooperation with the competent authority in order to discuss FinTech-related issues (share information and views, etc.) and seek clarification on the conformity of business models with the regulatory framework or on regulatory or licensing requirements (i.e. individual guidance on the interpretation of applicable rules).

A special contact point where FinTech and other companies may obtain free advice on the provision of financial services and on licencing requirements for FinTech companies.

Innovation sandbox enables businesses to test or assess innovative financial products, financial services or business models according to a special testing plan agreed with the sandbox creators. It is an environment, both physical and digital, with a set of tools enabling those generating ideas as well as project teams and start-ups to work together with the sandbox creators in real time in order to address challenges, explore possibilities and test concepts.

Innovation sandbox enables businesses to test or assess innovative financial products, financial services or business models according to a special testing plan agreed with the sandbox creators. It is an environment, both physical and digital, with a set of tools enabling those generating ideas as well as project teams and start-ups to work together with the sandbox creators in real time in order to address challenges, explore possibilities and test concepts.

Innovation sandbox is an environment that ensures the process of testing innovative financial products, financial services or business models according to a special testing plan agreed with the Financial and Capital Market Commission. Link to the Innovation Sandbox of the Financial and Capital Market Commission:

https://www.fktk.lv/licencesana/inovacijas-un-fintech/inovaciju-smilskaste/.

A service available within a new payment infrastructure ensuring the execution of interbank payments within a matter of seconds 24/7/365. In August 2017, Latvijas Banka was the first central bank of the Eurosystem to introduce the instant payment infrastructure which has been connected to other European payment systems since November 2017.

The main objective of introducing this service was to ensure fast, secure and effective payments for both private and legal persons and to remove the limitations imposed by the credit institutions' working hours. The instant payment service is not exclusive, and no additional fee is applied for the service.

A concept of connecting physical everyday devices in a single network. Internet of things allows devices to receive data and send them to the user and other devices. Thus, they can be operated – controlled, switched on and switched off – remotely.

A concept of connecting physical everyday devices in a single network. Internet of things allows devices to receive data and send them to the user and other devices. Thus, they can be operated – controlled, switched on and switched off – remotely.

Internet of things is a modern way of managing devices remotely by connecting them to the internet or another data transmission network. The connected devices may have various functions and sizes ranging from smart watches measuring heart rate and security cameras sending a warning when an unauthorised person enters the premises to agricultural drones and tractors. Smart devices in a home can also be connected to a single network and managed via smartphone or desktop apps. We call such homes smart as their temperature, lighting and other functions can be regulated remotely. If equipped with smart plugs, older-generation devices or more simple products such as lamps and kettles can also be connected to the internet.

The term KYC is usually used in the context of AML/CFT when performing customer due diligence.

The term KYC is usually used in the context of AML/CFT when performing customer due diligence.

Credit institutions are obliged to regularly verify their customers and obtain objective information to make sure that it is acceptable to start or continue cooperation.

Technologies available on smart devices. These technologies operate by using the device's processor, additional equipment (camera, fingerprint reader, etc.) as well as mobile and wireless networks.

Technologies available on smart devices. These technologies operate by using the device's processor, additional equipment (camera, fingerprint reader, etc.) as well as mobile and wireless networks.

With the technological solutions and the data transmission speed developing rapidly, the operations users can perform on their smart devices are becoming increasingly more diverse ranging from voice calls to high-resolution video streaming and remote identity verification based on biometric data. At the beginning of the 21st century, modern technologies have significantly changed our everyday lives. However, our over-reliance on devices raises discussion about digital security.

A money transfer system whose participants agree to uniform and standardised terms and procedures for payment processing and settlement.

A money transfer system whose participants agree to uniform and standardised terms and procedures for payment processing and settlement.

Payment systems are maintained by both central banks and commercial companies jointly shaping the payment system environment. Certain payment systems ensure, for instance, the settlement of the financial instruments or credit cards. Interbank settlement can be executed via clearing or real-time payment systems. The payments received via clearing systems are bundled in files, with the netting executed and the payment message sent to the receiving bank only at certain times of the day. In real-time payment systems, the settlement for each payment is executed immediately, notifying the receiving bank thereof.

The primary objective of the directive is to make the financial services market more open and available to new participants. PSD2 establishes new types of service providers authorised by customers to access their account information and even make payments from their accounts. In addition, PSD2 establishes stricter rules for customer authentication.

The primary objective of the directive is to make the financial services market more open and available to new participants. PSD2 establishes new types of service providers authorised by customers to access their account information and even make payments from their accounts. In addition, PSD2 establishes stricter rules for customer authentication.

EU Member States had to implement the Directive by 13 January 2018. PSD2 closely follows the idea of open banking as it makes available information that was previously accessed exclusively by banks. The security of user data is ensured based on the API technology. Regulation on strong customer authentication and common and secure open standards of communication came into effect on 14 September 2019. According to the new requirements, only authentication based on two or more security elements such as possession and knowledge shall be used.

This service allows the user to make payments from his/her own account on a third party's website (e.g., e-shop), without leaving the site, i.e. without performing internet banking authentication.

This service allows the user to make payments from his/her own account on a third party's website (e.g., e-shop), without leaving the site, i.e. without performing internet banking authentication.

With the user's permission, the payment initiation service provider initiates a payment on behalf of the payment service user from a payment account opened with the payment service provider.

The Proxy Registry "Instant Links" maintained by Latvijas Banka provides storage of credit institution customer account numbers and mobile phone number links, which allows customers to send each other money, knowing only the mobile phone number.

Customers of banks provide their mobile phone numbers to the Proxy Registry "Instant Links" via their banks, thus others can send them money more easily. If necessary, in future the Proxy Registry "Instant links" will support other identifiers as proxies, e.g., the e-mail address.

A rectangular module filled with smaller squares in a specific two-dimensional pattern. The module contains encoded information that can be read by using an appropriate device.

A rectangular module filled with smaller squares in a specific two-dimensional pattern. The module contains encoded information that can be read by using an appropriate device.

The information encoded in the QR Code can also contain a certain command, for instance, to open a particular website, make a payment for a received product or service, etc.

A commonly recognised term for technologies that can be used by market participants to follow regulatory and compliance requirements more effectively and efficiently.

A commonly recognised term for technologies that can be used by market participants to follow regulatory and compliance requirements more effectively and efficiently.

RegTech has emerged as a result of tightening AML/CFT, KYC and CDD requirements; many companies and banks are obliged to comply with these requirements and they have to make sure that their partners fulfil them as well.

Applications that combine digital interfaces and algorithms, and can also include machine learning, in order to provide services ranging from automated financial recommendations to contract brokering to portfolio management to their clients.

Applications that combine digital interfaces and algorithms, and can also include machine learning, in order to provide services ranging from automated financial recommendations to contract brokering to portfolio management to their clients.

Such advisors may be standalone firms and platforms, or can be in-house applications of incumbent financial institutions.

A contract that is stored on a blockchain and takes effect automatically, once all contract terms have been fulfilled.

A contract that is stored on a blockchain and takes effect automatically, once all contract terms have been fulfilled.

A smart contract ensures high precision, transparency, speed and security, since the information on the fulfilment of contract terms is available to all involved parties.

A type of crypto asset that is created based on an algorhythm which is trying to keep the value of the respective stablecoin 1:1 vis-à-vis the value of the "linked" asset.

A type of crypto asset that is created based on an algorhythm which is trying to keep the value of the respective stablecoin 1:1 vis-à-vis the value of the "linked" asset.

On crypto-exchanges, 99.8% of stablecoin transactions involve stablecoins whose value is linked to a currency, e.g., the US dollar or the euro. It can be, therefore, concluded that stablecoins are mainly used to hedge the income gained from speculations on crypto-exchanges against rapid exchange rate changes.

The initial stage of a business based on an innovative idea or new technology. A start-up develops products or services that are suitable for the international market and ensure dynamic business growth.

The initial stage of a business based on an innovative idea or new technology. A start-up develops products or services that are suitable for the international market and ensure dynamic business growth.

A start-up is based on an idea, and its primary objective is to test the potential of that idea and then implement it. The product or service of a start-up is improved, finished and tested in the market in order to attract investment and make the product or service available to the general public. The ideas developed by start-up founders do not always draw the attention of investors. In that case, the invested work will bring no profit but will only serve as a lesson. When attracting investment, start-up founders should also take into account that investors will want to have an ownership stake in the business or influence its strategy.

Authentication based on the use of two or more elements categorised as knowledge (something only the payment service user knows), possession (something only the payment service user possesses) and inherence (something the payment service user is).

Authentication based on the use of two or more elements categorised as knowledge (something only the payment service user knows), possession (something only the payment service user possesses) and inherence (something the payment service user is).

These elements are independent, i.e., one element losing its reliability does not compromise the reliability of other elements, and they are designed in such a way as to protect the confidentiality of the authentication data.

The use of technological innovations by supervisory authorities.

The use of technological innovations by supervisory authorities.

The use of various technological solutions (e.g., data analysis tools, data submission systems, etc.) by supervisory authorities to facilitate and make smarter the process of supervision.

A digital representation of value not issued or guaranteed by a central bank or any other public authority. A virtual asset can be stored, traded or transferred electronically. It can be compared with virtual money, e.g., bitcoin.

A digital representation of value not issued or guaranteed by a central bank or any other public authority. A virtual asset can be stored, traded or transferred electronically. It can be compared with virtual money, e.g., bitcoin.

For details, see the explanation by the Financial and Capital Market Commission: https://www.fktk.lv/tiesibu-akti/vispareja/fktk-ieteikumi-un-vadlinijas/skaidrojums-par-virtualo-aktivu-un-ico-izmantosanas-iespejam-un-piemerojamo-regulejumu/.

Virtual wallets are created on the user's smart device and secured with strong authentication in order to protect his/her finances in case the devise is stolen or lost

Virtual wallets are created on the user's smart device and secured with strong authentication in order to protect his/her finances in case the devise is stolen or lost

Virtual wallet may contain:

– an electronic money account opened by a natural or legal person in a closed system created and maintained by an electronic money institution; such an account can be used by the respective person to record issuance and repurchase transactions with electronic money and to record electronic money payments that are only executed in the closed system of the electronic money institution;

– a payment account opened in the name of one or more payment service users and used for the execution of payments.