Information hotline to customers

The payment of guaranteed compensation T. +371 67022801

On transactions in financial instruments T. +371. 67022807

Other issues T. +371 67022819

E-mail:

To ensure the stability of Latvia’s financial sector and protecting the interests of bank’s customers and creditors, the Board of the Financial and Capital Market Commission (FCMC) on 12 December 2022 decided to suspend the provision of financial services at Baltic International Bank SE. The FCMC has recognized Baltic International Bank SE as failing or likely to fail and decided not to take resolution action of Baltic International Bank SE, which means to take no actions in order to stabilise bank activities.

The FCMC has based its decision to recognise Baltic International Bank SE as failing or likely to fail on the grounds that the bank has not been able to ensure the implementation of a viable business strategy over a sustained period. The current business strategy does not conform to the bank’s capacity and is not feasible, therefore the bank has been continuously failing to provide a profitable business model. The bank also has serious internal governance deficiencies, including the area of the prevention of money laundering and terrorism and proliferation financing. Despite the efforts of the FCMC to make improvements in these areas, the bank has not ensured compliance of its activities with the regulatory requirements governing the activities of credit institutions, as well as continues the current trend: the bank operates at a loss, is unable to restore profitability, fails to ensure an adequate internal control system and a stable future vision.

The Board of the FCMC on 13 December 2022 took a decision on the unavailability of deposits at Baltic International Bank SE in order to protect the interests of bank’s customers by preventing a bank run.

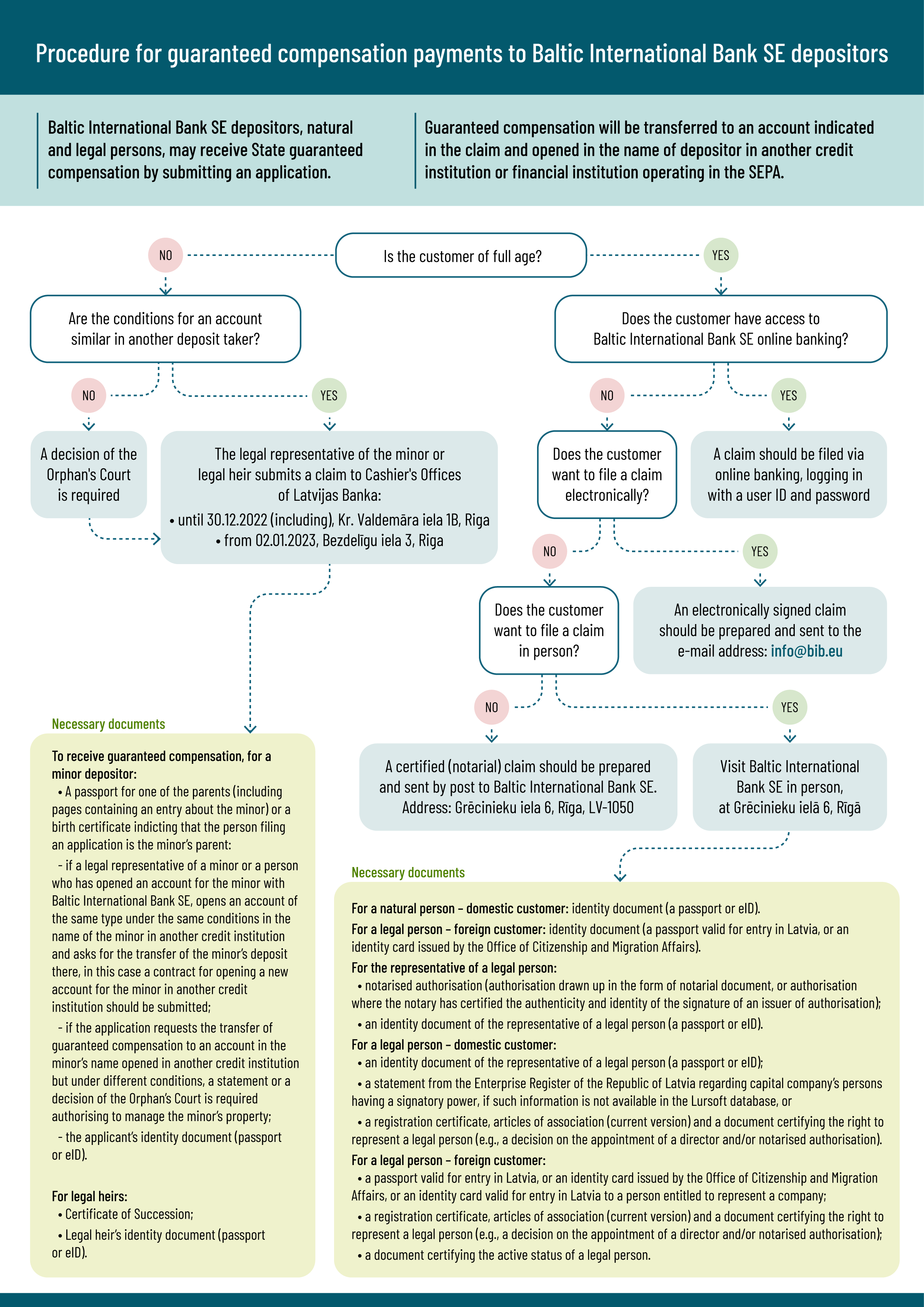

The FCMC has made a decision on the procedure for the guaranteed compensation payments to the depositors of Baltic International Bank SE starting from 22 December. Depositors can apply for the guaranteed compensation until 12.12.2027.

On 10 March 2023, the European Central Bank has taken a decision to withdraw the banking licence of Baltic International Bank SE, a less significant institution directly supervised by Latvijas Banka. The decision took effect on 11 March 2023.

By decision of the Court of Economic Affairs dated 24 March 2023, Baltic International Bank SE was recognized as the institution to be liquidated and the process of its liquidation was initiated. Olavs Cers, a sworn attorney, has been approved as the liquidator of Baltic International Bank SE.

By its judgement of 24 March 2023, the Court of Economic Affairs ruled that Baltic International Bank SE was to be liquidated, and its liquidation process was initiated. Based on the judgement passed by the Court of Economic Affairs on 24 March 2024, Baltic International Bank SE was declared insolvent. Linda Sniega-Svilāne has been confirmed as the insolvency administrator for the insolvent Baltic International Bank SE. The address of Baltic International Bank SE to be liquidated is Grēcinieku iela 6, Riga, LV-1050. Claims by creditors and other persons, as well as other complaints against Baltic International Bank SE to be liquidated had to be submitted to the liquidator within three months from the date of publication of the announcement. After this deadline, the creditor claims submitted will be reviewed and satisfied in accordance with the procedure stipulated in Paragraph three of Section 139.3 of the Credit Institution Law.

Guaranteed compensation payments

The FCMC will ensure the guaranteed compensation payments through Latvijas Banka using the information systems of Latvijas Banka, thus enabling the depositors to receive their guaranteed compensation as quickly and easy as possible within the time limits specified by the Deposit Guarantee Law. Guaranteed compensation disbursement arrangements for Baltic International Bank SE customers The guaranteed compensation will be paid in a single lump-sum payment in the euro currency transferring it to an account opened in the name of Baltic International Bank SE depositor in another credit institution or financial institution operating in Single Euro Payments Area (SEPA). Baltic International Bank SE customers who have access to online banking Baltic International Bank SE customers – depositors may claim the guaranteed compensation to which they are entitled through online banking system of Baltic International Bank SE and by submitting an application for guaranteed compensation. Baltic International Bank SE customers who do not have access to online banking The bank’s customers – depositors who do not have access to Baltic International Bank SE online banking may claim guaranteed compensation in any of three ways: Baltic International Bank SE customers – minors The legal representative of the minor submits the guaranteed compensation claim at the premises of Latvijas Banka during working time. Address:Cashier’s Offices of Latvijas Banka at Bezdelīgu iela 3, Riga. Information on working time of Cashier’s Offices available at: https://www.bank.lv/en/about-us/contacts/cashier-s-office. According to the application of the legal representative of the minor depositor or the person who opened the account for the minor depositor, guaranteed compensation payment will be transferred to the account indicated in the application, opened in the minor’s name in any other deposit taker with the conditions for the use of existing funds similar to those laid down by Baltic International SE. The FCMC will immediately notify the legal representative of the minor depositor regarding the transfer of the guaranteed compensation (deposit) to the account of the minor. The Latvian Deposit Guarantee Scheme provides for guaranteed compensation up to EUR 100 000 for each eligible customer. It shall be paid to both natural and legal persons for all types of deposits in any currency. The guaranteed compensation applies to the deposits of bank’s customers, as well as deposit interest accrued until the date of occurrence of the unavailability of deposits. In accordance with Section 22 (1) of the Deposit Guarantee Law, the FCMC has imposed an obligation on Baltic International Bank SE to cover the claim in the amount of compensation according to the calculation by the FCMC. Guaranteed compensation will be paid only in the form of transfer into account opened in the name of depositor in any credit institution or payment institution after an application is submitted. Yes, to receive guaranteed compensation a basic payment account may be opened in a credit institution whose business model provides for the provision of payment account-related services to the EU residents – consumers. The full amount of deposit is guaranteed for the customers whose deposits do not exceed 100 000 euro. These customers will receive the guaranteed maximum amount – 100 000 euro. Customers whose deposited amount is above the guaranteed compensation of 100 000 euro will be able to make a creditor’s claim for the remaining amount as part of the bank liquidation process. The customers whose deposited amount is above the guaranteed compensation of 100 000 euro will be able to make a creditor’s claim for the remaining amount as part of the bank liquidation process. More information about the process will follow in the near future.

Frequently asked questions

The suspension of the bank does not affect the customers’ obligation to fulfil their obligations. While the conditions of the loan agreement are met, no one is entitled to make any changes in those conditions or recover the credit from the customers before the set term. The customers should not worry as long as they are fulfilling their obligations in a timely manner. Baltic International Bank’s clients owing loan or other payment obligations to Bank are obligated to continue to perform all payments that have already occurred and shall occur in future in accordance with the repayment schedules specified in the entered loan agreements, by making future transfers regarding to the fulfilment of their obligations to the following payment details in euro currency only: Beneficiary: Baltic International Bank SE Registration No. 40003127883 address: 43 Kaleju Street, Riga, LV-1050 Account No. LV98CBBR1130131400070 Beneficiary’s bank: BluOr Bank AS SWIFT code: CBBRLV22 Payment details for loan obligations: Borrower’s data (Natural person: full name, personal (ID) number (LR residents), date of birth (LR non-residents) / Legal person: official name, registration number) payment according to the Loan Agreement No. ___/___/___ Payment details for card loan limit payments: Borrower’s data (Natural person: full name, personal (ID) number (LR residents), date of birth (LR non-residents) / Legal person: official name, registration number) payment to clear credit card limit according to the Customer Service Agreement No. ___/___/___ Payment details for commissions and other services payments: Payer’s data (Natural person: full name, personal (ID) number (LR residents), date of birth (LR non-residents) / Legal person: official name, registration number) payment according to the Agreement No. ___/___/___ Please note that the account provided accepts only payments for Bank’s services (loan and other obligations fulfilment, as well commissions and fees). Clients, who’s loan and other payment obligations occurred after December 12, 2022 and have been unable to make payment until the date this notice was sent, shall not be a subject to the late-payment penalties set in existing loan agreements. If securities have been purchased, then the customer needs to open a financial instruments account with another bank and submit a securities transfer order. Funds that have not been invested in securities are included in the total guaranteed compensation amount. 1. A fixed-term deposit account opened for a minor: The legal representative of the minor or the person who opened the account for the minor with BIB, shall open the account of same type in the name of the minor in another credit institution and request a transfer of the deposit to this account, in this case a decision of the Orphan’s Court is not required. If an account in another credit institution is opened under other conditions, such as a basic account where to transfer the deposit, then a decision of the Orphan’s Court regarding the right to handle the minor’s property should be received. 2. If a basic account is opened for a minor attached to the legal representative, the deposit in that account will be summed up with the deposit of legal representative and will be paid out at the request for guaranteed compensation payment from the legal representative. Baltic International Bank’s safe deposit boxes remain available to clients. Baltic International Bank invites clients to contact their private banker to schedule visit to the vault.