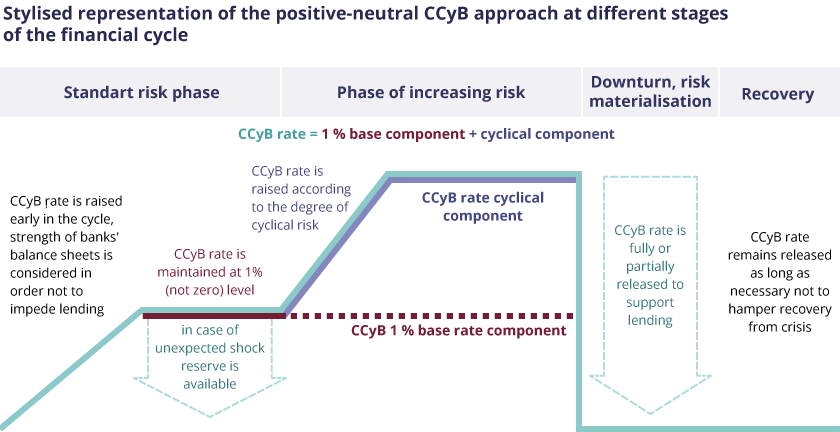

Taking into account the international experience and acknowledging that by pre-emptively increasing the countercyclical capital buffer (hereinafter – CCyB) earlier in the financial cycle, there is a greater possibility to timely build sufficient bank resilience buffers that can be used during periods of financial stress, including unexpected systemic (pandemic, geopolitical, macro-financial) shocks, Latvijas Banka starts to implement a positive neutral CCyB application approach.

In line with this approach:

- the CCyB rate is maintained at a fixed base level above 0% already under standard risk conditions or in the neutral phase of the financial cycle, when the cyclical systemic risk is neither elevated nor significantly low. Latvijas Banka has considered 1% to be an appropriate base level of the CCyB rate;

- Latvijas Banka will continue to assess the intensity of the cyclical systemic risk on a quarterly basis. As soon as the cyclical systemic risk increases, the CCyB rate will be raised proportionally to the intensity of the cyclical systemic risk, already from the positive base rate rather than zero;

- in times of crisis, when risks materialise, and in the post-crisis recovery period, the CCyB rate may be partially or fully released.

To start the implementation of the positive neutral CCyB approach, on 18 December 2023, the Council of Latvijas Banka decided that the CCyB rate of 0.5% would take effect on 18 December 2024 and 1% – on 18 June 2025.

The Latvian credit institutions are performing well, while funding costs remain low. At the same time, other relevant risks should be accounted for, including the lessons learnt in recent years in the context of the pandemic and Russia's invasion of Ukraine. Large-scale shocks can occur suddenly and unexpectedly, uncertainty remains high, and the Latvian economy is particularly exposed to external developments due to its size and openness. It is therefore prudent to take advantage of good financial conditions for a timely build-up of additional resilience buffers for a future event where risks may materialise. The current financial conditions of Latvian credit institutions allow them to strengthen their resilience without negative procyclical effects.

The early and gradual build-up of buffers protects against unexpected large shocks, reduces uncertainty associated with the timely identification and materialisation of risks, and increases flexibility in the implementation of macroprudential policy throughout the financial cycle as the CCyB is the macroprudential capital instrument that can be most efficiently released in the event of a financial crisis.

The intention to increase the CCyB rate to 1% in December 2023 and to launch a positive neutral CCyB approach has already been announced in Latvijas Banka's statement published on 19 July 2023 following the meeting of the Macroprudential Council.*A collegial advisory forum for cooperation between Latvijas Banka and the Ministry of Finance for promoting financial stability.

For more information

Latvijas Banka's approach to the application of the CCyB:

Further information on the CCyB

According to Paragraph one of Section 35.5 of the Credit Institution Law, Latvijas Banka is the institution responsible for setting the CCyB rate in Latvia. Latvijas Banka shall, on a quarterly basis, evaluate the intensity of cyclical systemic risk and, if necessary, determine or adjust the CCyB rate which is applicable to exposures with residents of the Republic of Latvia. Every quarter, Latvijas Banka shall also publish an assessment of the cyclical systemic risk and the applicable CCyB rate. If no change in the CCyB rate is necessary, the previous decision on the CCyB rate shall remain in force.

The CCyB is a macroprudential tool that can be used to strengthen the resilience of credit institutions in the neutral and boom phases of the financial cycle so that credit institutions have sufficient loss-absorbing capacity in times of crisis. The CCyB buffer is partially or fully released when risks materialise in order to help credit institutions continue to offer funding to the economy. This reduces the duration of crises and their impact on the economy.

The positive neutral CCyB approach has growing support internationally and is already being implemented in the United Kingdom, Australia, Hong Kong, the Czech Republic, the Netherlands, Ireland, Cyprus, as well as in countries important for our financial sector – Lithuania, Estonia and Sweden.