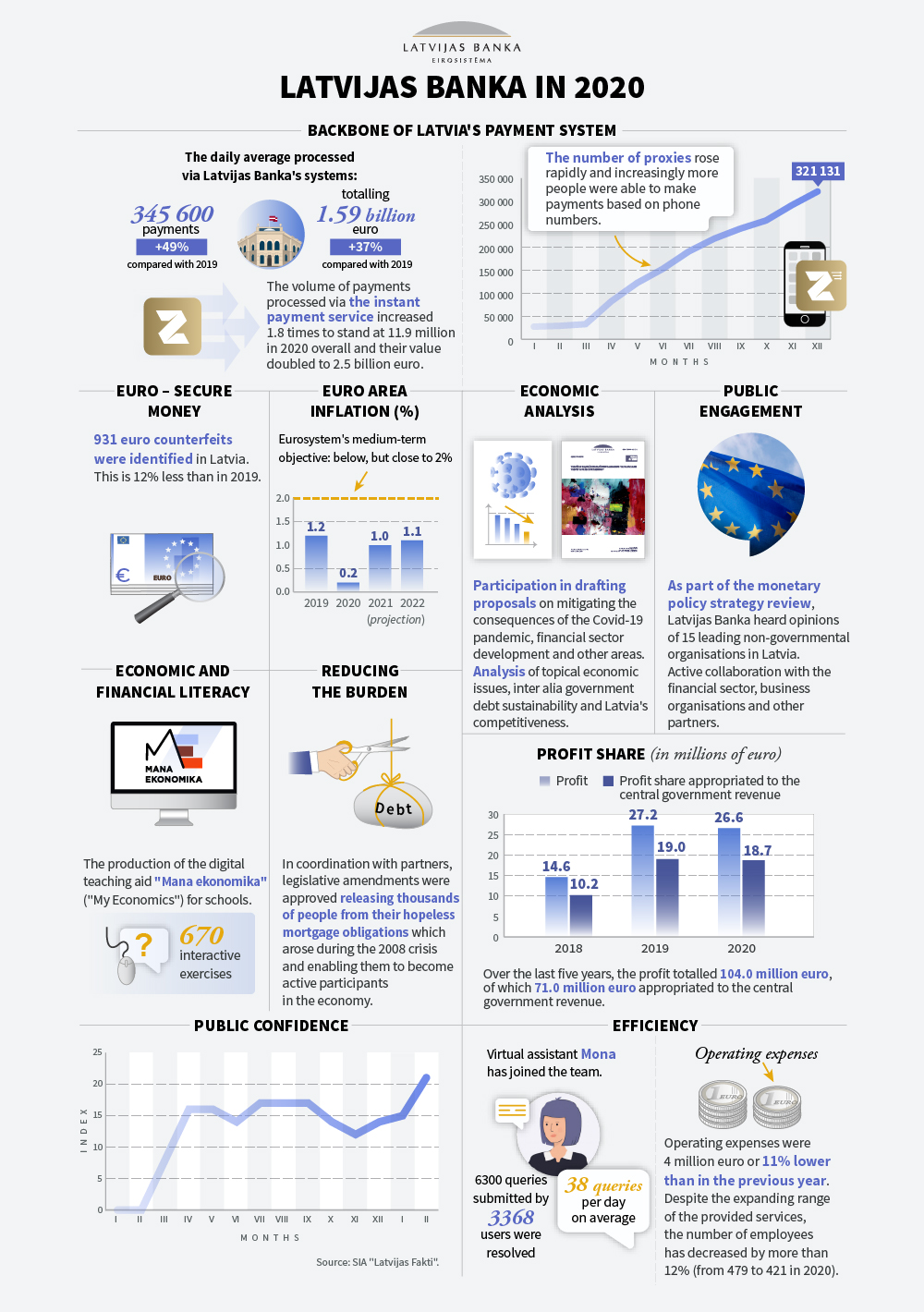

The Board of Latvijas Banka has approved Latvijas Banka's financial statements for 2020. According to the statements, Latvijas Banka's profit for the year 2020 totalled 26.6 million euro, roughly the same as in 2019 when it was 27.2 million euro.

Pursuant to the Law on Latvijas Banka, Latvijas Banka's annual financial statements are audited by independent external auditors recommended by the Governing Council of the European Central Bank and approved by the Council of the European Union. Latvijas Banka has received a positive auditors' opinion on its financial statements for 2020 from the auditing company SIA "ERNST & YOUNG BALTIC".

Pursuant to the Law on Latvijas Banka, 70% or 18.7 million euro of Latvijas Banka's profit for 2020 will be appropriated to the central government budget; the rest of the profit will be transferred to the reserve capital of Latvijas Banka.

Over the last five years, Latvijas Banka's total profit has reached 104 million euro, with 71 million euro appropriated to the central government revenue.

In 2020, Latvijas Banka continued to develop an efficient, secure and state-of-the-art payment infrastructure, inter alia doubling the volume and value of processed instant payments over the year and rapidly improving the availability of instant links (proxies). Instant links enable credit institution customers to make instant and other payments in a more convenient and faster way, just indicating the payee's mobile phone number or another identifier linked to the customer account when making a payment. At the end of 2020, 321 thousand instant links were registered with the Proxy Registry "Instant Links", i.e. 13 times more than at the end of 2019. The Proxy Registry received 3.7 million requests, 215 times more than in 2019. The active engagement of Latvijas Banka enabled credit institutions in both Latvia and Estonia to use the Proxy Registry.

As regards cash, in 2020 the central bank processed 133.7 million banknotes received from credit institutions; of them, 8.7% or 11.6 million were replaced with new ones. As part of improving cash processing, work at automation and modernisation of banknote counting processes continued.

Economic analysis and research is another essential area of Latvijas Banka's activities. Analysis-based understanding of the current developments is an essential precondition for defining top quality economic policy decisions. This is particularly topical in periods of economic downturn and heightened uncertainty. The Covid-19 pandemic and the related response of economic policies both in Europe and Latvia made Latvijas Banka also essentially review its research priorities and adapt the macroeconomic forecasting process. Latvijas Banka was also an active participant of the government working groups developing economic support measures to overcome the consequences of the Covid-19 pandemic.

In 2020, Latvijas Banka continued its research activities focusing on three priorities: monetary policy transmission, fiscal policy and public debt sustainability, and long-term growth and competitiveness.

An in-depth study of the underlying factors for interest rates on loans to domestic non-financial corporations was also conducted in 2020, analysing the Credit Register granular data with the help of econometric models.

Several publicly significant initiatives were implemented in 2020, for example, as a result of a joint effort with the financial sector partners, the Saeima passed legislative amendments releasing thousands of people from their hopeless mortgage debt dating back to the financial crisis of 2008–2009 and enabling them to become full participants in the economy again. The development of the digital teaching aid "My Economics" for schools was continued with a view to improving the quality of teaching economics. Latvia was also actively engaged in the European Central Bank's monetary policy strategy review, inviting Latvia's population also to share views on the future of the monetary policy and building closer links with the public needs.

See the attached infographic outlining the most significant accomplishments of Latvijas Banka in 2020.

There are several activities affecting the general public on Latvijas Banka's agenda for 2021, including:

- the introduction of an innovative Instant payment request service. The Instant payment request service will be an interbank solution enabling an instant sending of a request to the payer who will only have to approve the request for the initiator of the instant request to receive the payment immediately. The new service will enable businesses and public institutions to send payment requests including billing information for direct approval (payment) without having to enter the payment details. This will increase the efficiency of the payment process, reduce the potential for errors and speed up the payment of bills in Latvia.

- an initiative aimed at preserving wide availability of cash also in Latvia's regions. There is an intention to discuss the potential introduction of the minimum free-of-charge service and reachability criteria: the minimum number of ATMs, maximum distance to the closest ATM, minimum amount of cash disbursed without a fee, minimum hours during which an ATM should be accessible. Discussions with the professional cash handlers have already commenced;

- strengthening research, with a focus on issues significant to sustainable development of Latvia;

- introduction of a centralised data catalogue in the field of financial statistics, including automation of information collection/compilation and handling/management.

The agenda for 2021 also includes certain developments with a significant effect on the daily operation of Latvijas Banka and the near-term development of the overall financial sector, inter alia further proceeding with the adoption of the new Law on Latvijas Banka by the Saeima. The Law provides for integration of the Financial and Capital Market Commission and the merged institution is scheduled to become operational as of 1 January 2023. At the same time, a change of the management model of Latvijas Banka is scheduled already this year, with a transition to a single level management.